Almost all workers in the UK are entitled to be paid at least the National Minimum Wage – or the National Living Wage if you’re 25 or over.

HMRC identified a record £15.6m of underpayments for workers on the minimum wage this year, which saw some 600 employers fined £14m for not meeting legal obligations. This was double the previous year’s figure and the highest number since the National Minimum Wage came into force.

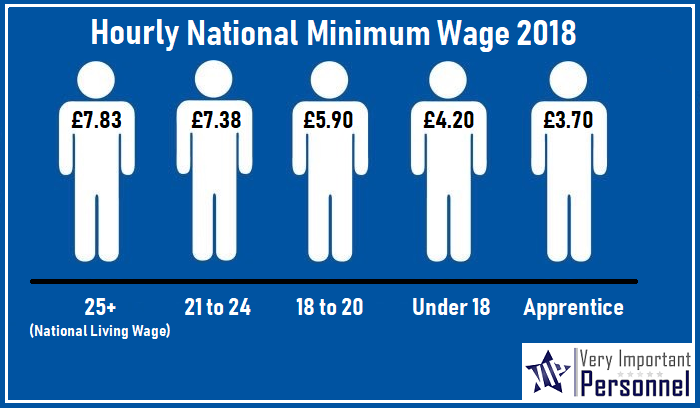

With record numbers of workers underpaid last year, VIPersonnel are here to remind you that the current rates for the National Minimum Wage are as follows:

25+ = £7.83

21 – 24 = £7.38

18 – 20 = £5.90

Under 18 = £4.20

Apprentice = £3.70

All the rates of the National Minimum Wage (NMW) increased on 1st April 2018 to the above rates, including the National Living Wage (NLW). The National Minimum Wage is worked out as an hourly rate, but it applies even if you are not paid by the hour.

So are you entitled to the National Minimum Wage?

You must be at least school leaving age (the last Friday in June of the school year in which you turn 16) to get the National Minimum Wage.

Almost all workers are entitled to the NMW, including:

- Casual workers

- Part-time workers

- Temporary workers

But if you’re self-employed or a company director, you’re not entitled to the National Minimum Wage.

What doesn’t count towards the National Minimum Wage?

You might be paid at a higher rate than your standard pay rate for some of the work you do – for example, for working:

- Overtime, weekend or night shifts

- On bank holidays

- Longer than a certain number of hours.

If you are, the premium element of pay – that is, the amount the higher pay rate exceeds your basic rate – does not count towards your minimum wage pay.

Your employer also cannot count the following towards your minimum wage pay:

- Tips or gratuities

- Service charges

- Cover charges from customers.

However, your employer can include incentive payments or bonuses as part of your basic pay.

Need help?

For further advice on the National Minimum Wage, National Living Wage, or any other rates, call our trusted business associates, Honest Employment Law Practice (H.E.L.P) on 01543 431 050.

Honest Employment Law Practice Ltd offer a pay-as-you-go monthly retainer service across the UK. Employment Law advice, HR advice and Health & Safety consultants with no long term contracts for clients both in the Public and Private sector – just Help on your terms! From full support for the smaller business, to assistance for the existing staff of larger companies, they can tailor a service specifically for your needs.

Looking for a new start?

The good news is, that all of our current vacancies are well above the National Minimum Wage, Take a look.